Venture Capital term sheets: The basics

- Growth

- Article

- 4 minutes read

A term sheet is a document, ranging from 1 to 10 pages, that serves as a summary of the more detailed investment agreements to come - the shareholders' agreement and articles of association.

Although it’s not legally binding, it can be difficult to renegotiate terms after you’ve signed the term sheet. That’s why it’s important to not only understand the terms and their implications, but also to negotiate where necessary.

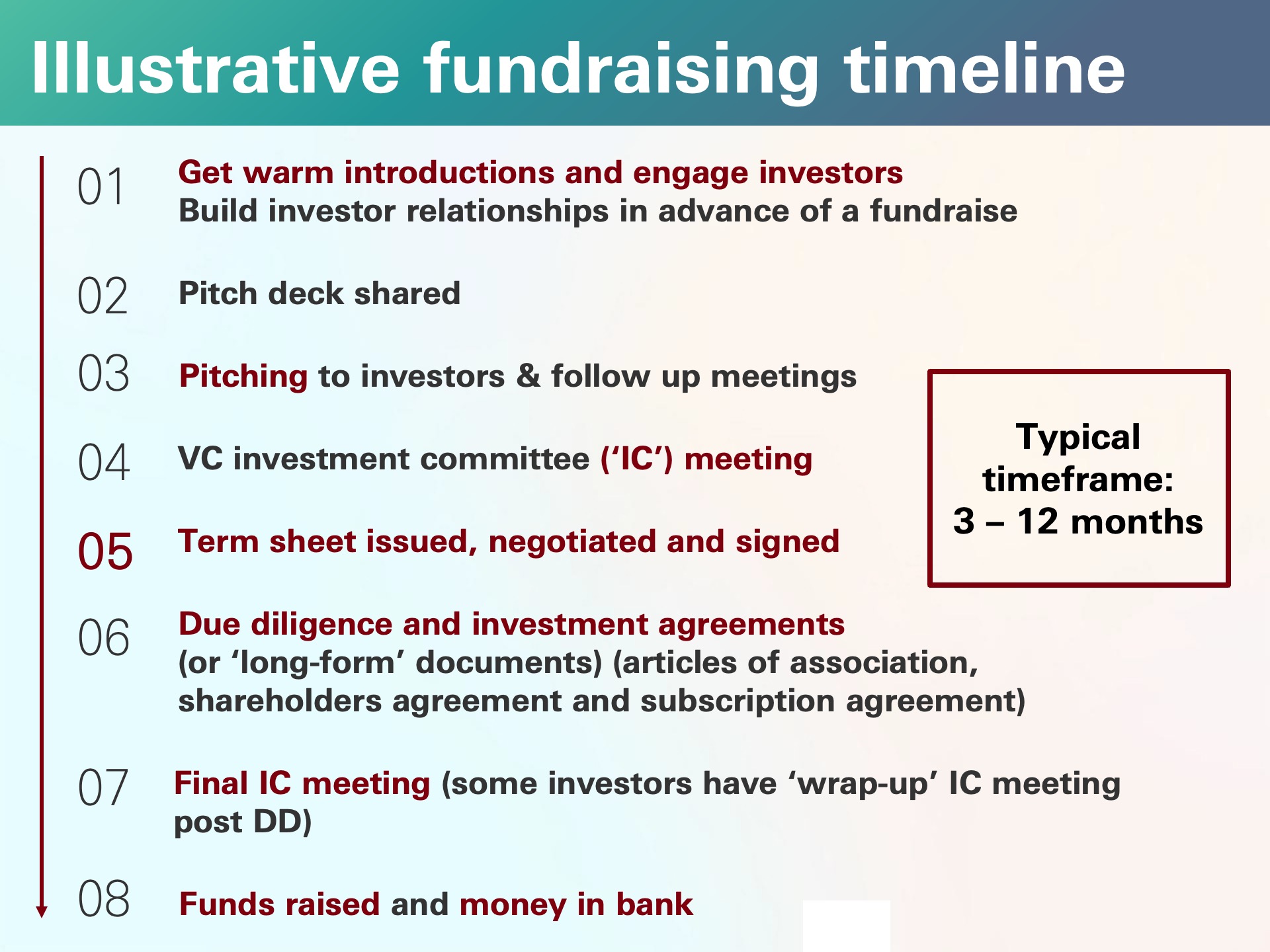

The term sheet is the pivot between pitching and getting money in the bank – a process that usually takes between 6 and 12 months. It confirms that investors are ready to invest, but it’s not a final agreement: both parties need to negotiate and agree to the terms of a possible deal.

The way you negotiate your term sheet will help to set the tone for the rest of your relationship with the investor – but how do you know what’s up for debate?

It’s best to focus on the terms that matter most to you – your “deal killers” – and to take a considered but reasonable approach to the rest.

Although a VC term sheet is non-binding in many respects, this plan will serve as a guide for your investor agreements going forward, so it’s important to understand which terms are most important to you and the business.

If you are uncertain about which terms to prioritise, work with a trusted advisor or an experienced startup lawyer to identify those that will help you the most. Typically, however, the most important points are:

If you have multiple offers, you may have more leverage to tilt the terms in your favour, but in general being flexible is helpful in building a healthy working relationship.

However, it’s equally important to make sure you understand the implications of every aspect of the term sheet. Working with a lawyer or advisor is essential.

Vanessa Vasquez, Head of Legal, Seedcamp"Adept legal counsel not only secures your present but also strategically prepares you for the future, ensuring every aspect of your business rests on solid legal foundations."

Any opinions expressed are merely opinions and not facts. All information in this document is for general informational purposes and not to be construed as professional advice or to create a professional relationship and the information is not intended as a substitute for professional advice. Nothing in this document takes into account your company’s individual circumstances. HSBC Innovation Banking does not make any representations or warranties with respect to the accuracy, applicability, fitness or completeness of this document and the material may not reflect the most current legal or regulatory developments. HSBC Innovation Banking disclaims all liability in respect to actions taken or not taken based on any or all of the contents in this document to the fullest extent permitted by law. Nothing relating to this material should be construed as a solicitation or offer, or recommendation, to acquire or dispose of any investment or to engage in any other transaction.