Understanding employee option pools

- Growth

- Article

- 5 minutes read

An employee option pool, or employee stock option pool (ESOP), is equity specifically allocated for employees.

These pools impact the ownership stake of founders and existing investors, making it a critical negotiation point. Our 2025 Term Sheet Guide revealed that in 71% of cases, an option pool was created or there was a top-up to the existing pool mentioned in the term sheet. They are common terms, and it’s important for founders to carefully consider the size and potential impact of an option pool.

The primary reasons why startups use employee stock options are to incentivise talent to join the company, and to reward employees without increasing their cash burn rate.

While offering options can be costly from an equity perspective, it allows startups to compensate employee’s with equity instead of paying high salaries, which might not be feasible depending on the business’ maturity.

Toyosi Ogedengbe, a Principal at Ascension, points out:

Toyosi Ogedengbe, Principal, Ascension"When negotiating a term sheet, founders should not view share options as a cost but as an investment in incentivising their team to drive the company’s vision. Thoughtfully structured options can attract and retain top talent, aligning interests towards long-term value creation."

Employee option pools have long been a standard in the startup world in the US and are now common across Europe. The size of the employee option pool is often negotiated between founders and the lead investor during a funding round.

Investors will want to see that a sufficient option pool is available to attract and retain top talent, but what size is right for the company?

According to our 2025 Term Sheet Guide1, the most common size for an option pool is between 10% and 15% of company equity, with 10% being the most frequent choice. This is consistent regardless of whether the pool is calculated pre- or post-money.

During a funding round, founders and investors must decide whether to factor the employee equity pool into the pre-money or post-money valuation. This decision has a significant impact on how new and existing shareholders are diluted.

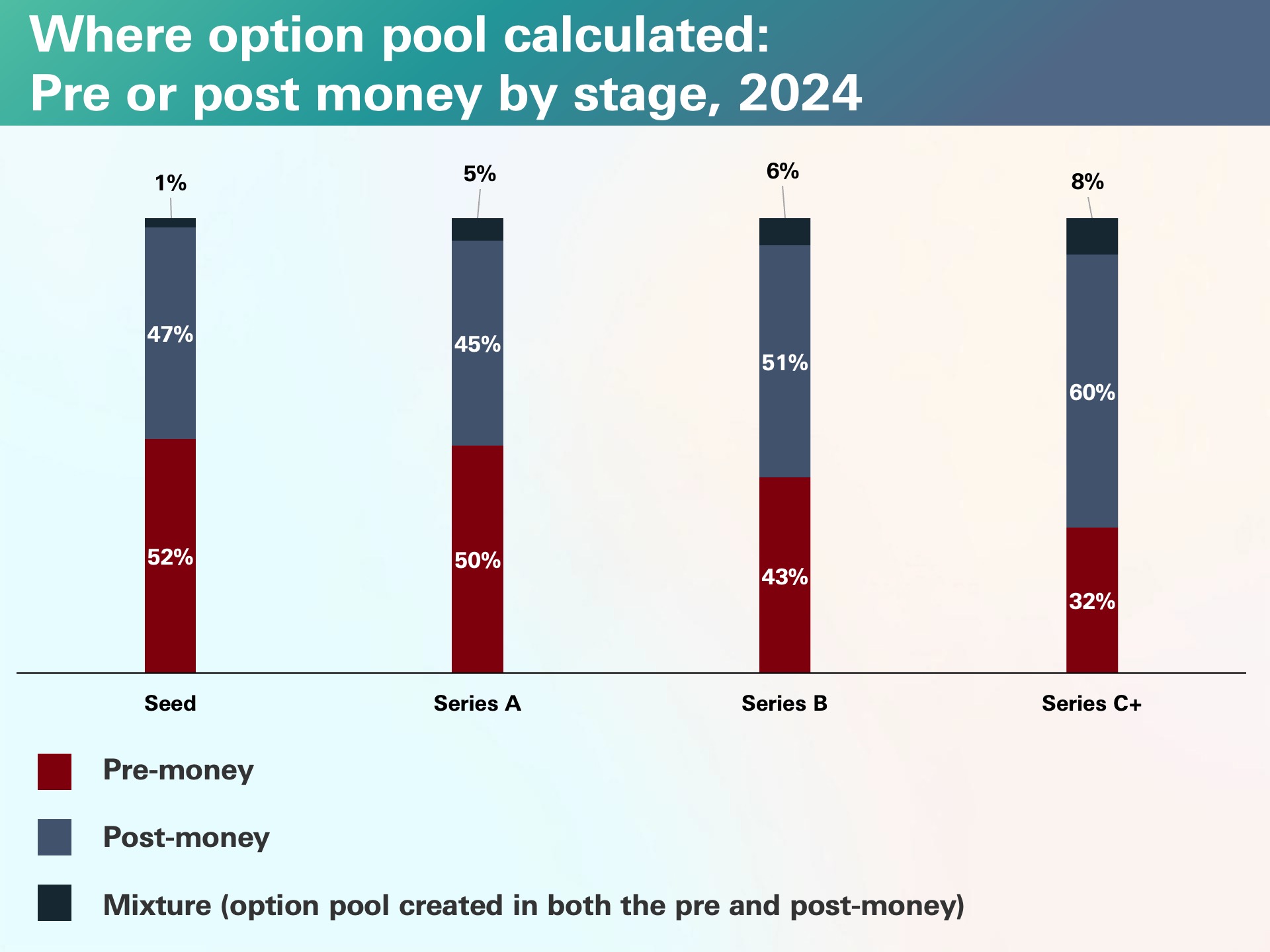

In the chart below you can see that the spread between pre and post money is split relatively evenly, but what are the implications?

A pre-money option pool assumes that the option pool is created before the assumed investment round occurs.

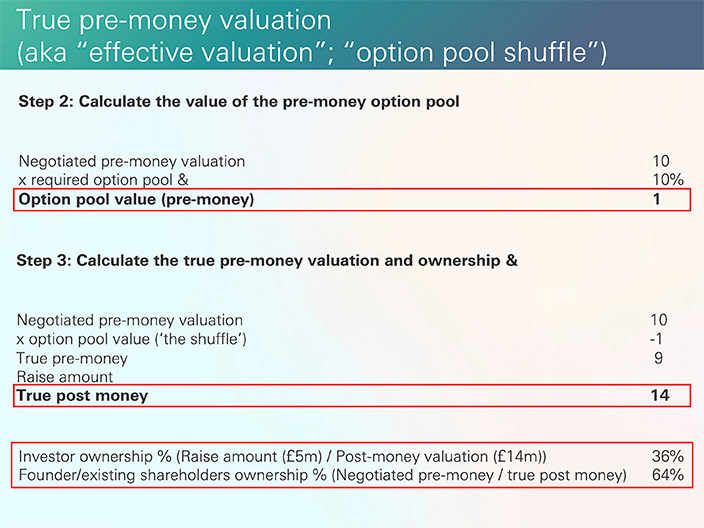

Doing this dilutes all existing shareholders but not the new investor. This leads to what is known as the “option pool shuffle”. This shuffle means founders get diluted twice: first by the creation of the option pool and again when new shares are issued as part of the funding round.

In a post-money option pool scenario, the employee option pool is set up or adjusted after accounting for new investors’ shares. Here, both existing shareholders and incoming investors share the dilution. This approach is commonly seen as “founder-friendly” because it spreads the dilution across all shareholders, not just the founders.

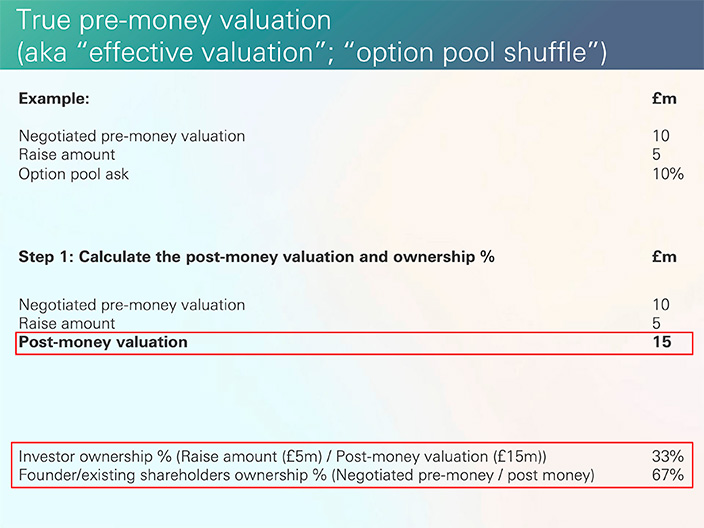

Here’s an example of the impact of each scenario:

Negotiated pre-money valuation: £10m

Raise amount: £5m

Option pool size: 10%

There is not a universally “right or wrong” answer when it comes to structuring option pools.

In the US, option pools are typically calculated in the pre-money valuation, but practices in the UK vary more widely.

When receiving a term sheet, founders should always request a cap table as part of the appendix. A transparent cap table – a table that outlines who owns what parts of the venture - will clearly show the impact of the option pool on equity ownership, whether calculated pre- or post-money.

Understanding valuation mechanics and equity ownership can help founders negotiate more effectively with investors. This could involve pushing for a higher pre-money valuation to offset the impact of the option pool shuffle or creating the option pool based on the post-money valuation and relevant equity ownership positions.