A deep dive into term sheet liquidation preferences

- Growth

- Article

- 5 minutes read

Liquidation preferences dictate how proceeds are distributed to shareholders when your company is sold, merged, or liquidated.

It’s a way for investors to protect their capital by making sure they’re paid back before common shareholders - typically the founders and employees holding ordinary shares - receive any payout.

At a high level, there are two components of a liquidation preference:

Here’s what each element means.

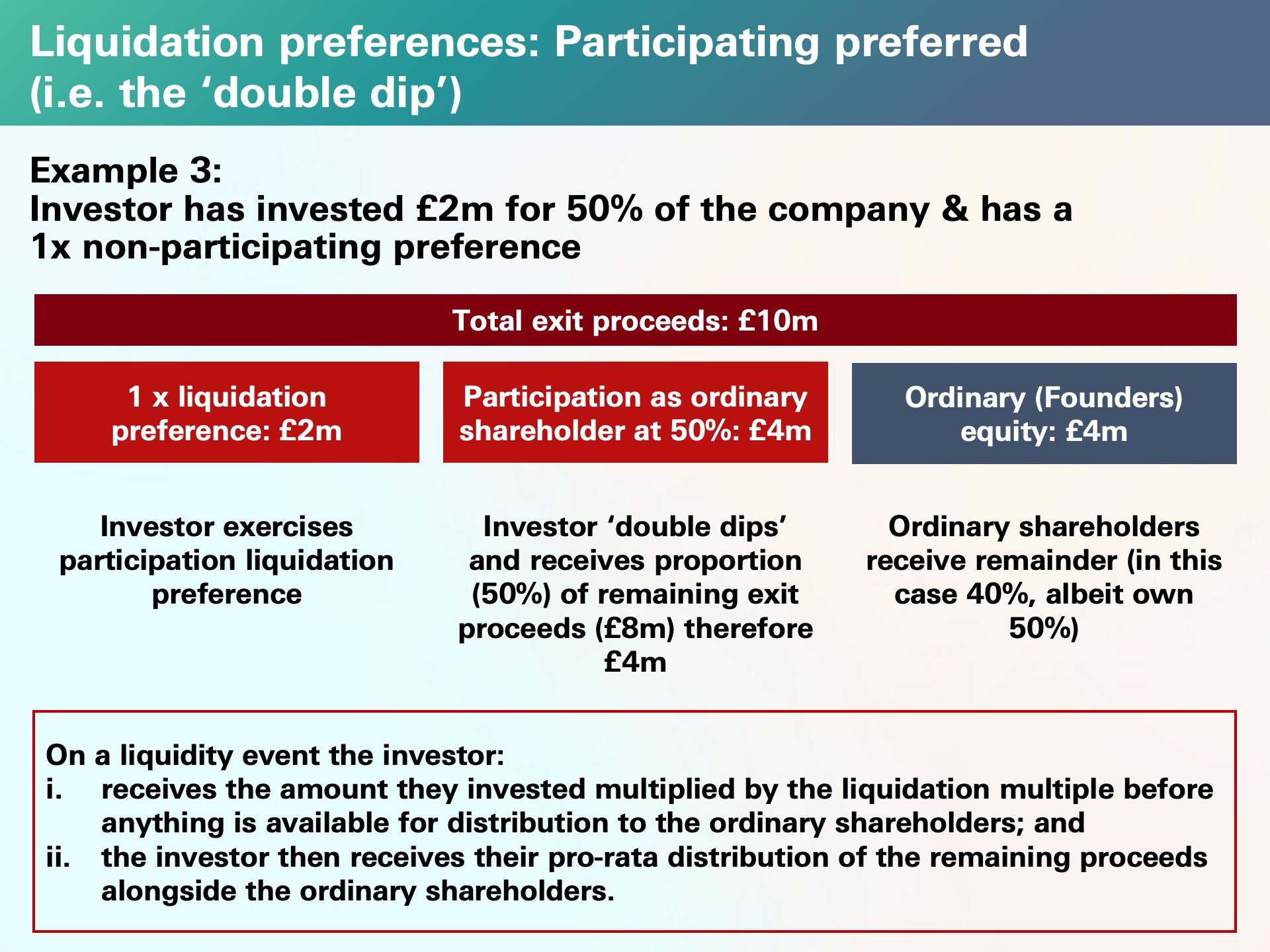

With a participating liquidation preference, preferred shareholders receive their original investment back plus a percentage of the remaining proceeds after the original investment has been repaid.

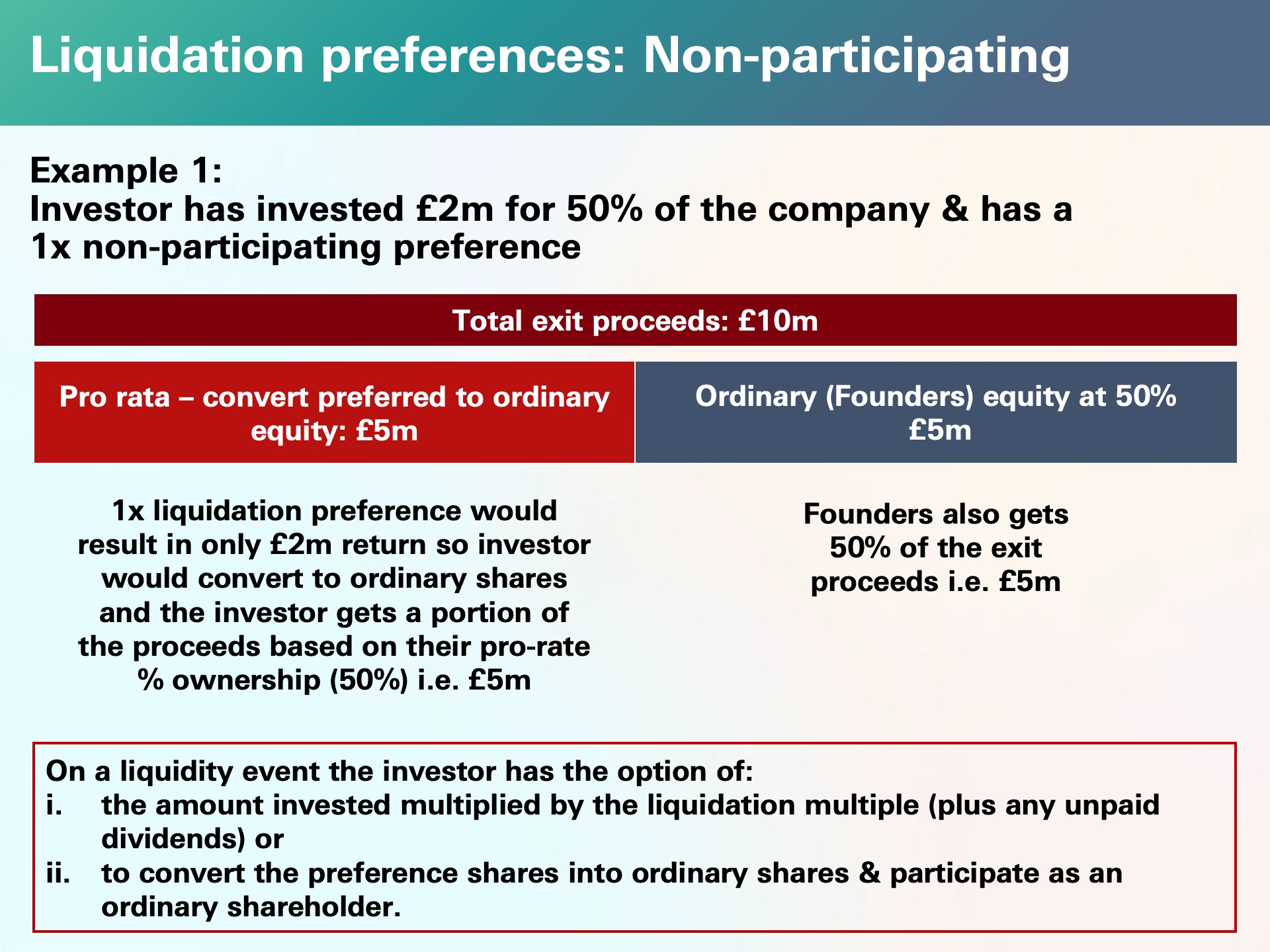

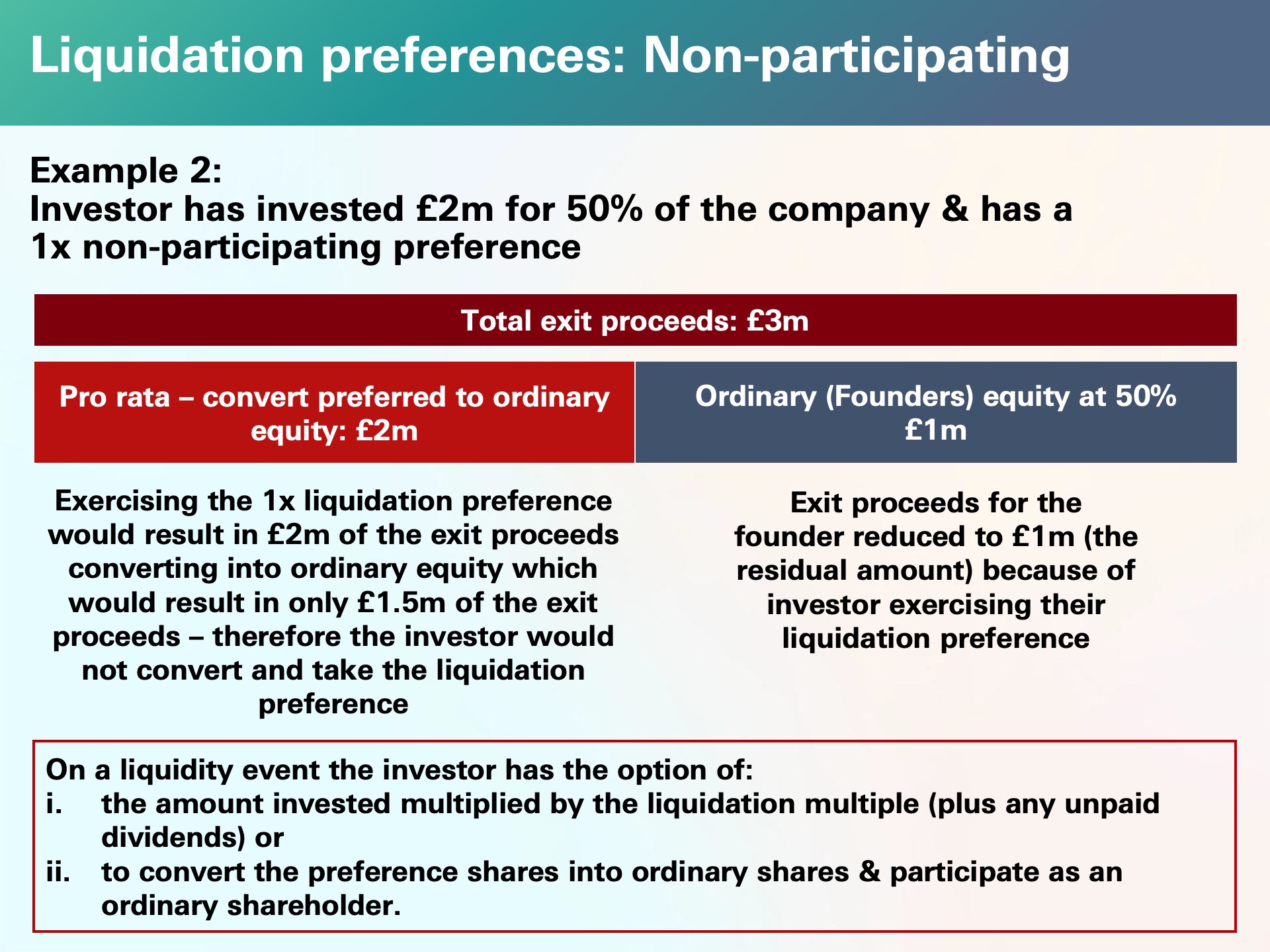

A non-participating liquidation preference means that the investor will receive whichever amount is higher between the 1x investment amount and their pro rata share of the remaining proceeds.

Let’s bring this to life with an example.

Imagine an investor invests £2M, and holds 50% of all shares in a company. Here’s a breakdown of how much they would get depending on their liquidation preference and the total exit proceeds.

*Reminder: With a non-participating preference the investor will receive the 1x investment amount or the pro rata proceeds, whichever is higher.

In 2024, 87% of preference shares in the UK were non-participating, down slightly from 89% in 20231. This suggests that even in a difficult market, non-participating preference shares are the norm.

The second important part of liquidation preferences is the liquidation multiple.

A liquidation multiple is the multiple of the investor's initial investment that they are entitled to before ordinary shareholders receive any proceeds. For instance, a 1.0x liquidation preference means the investor will get their original investment back, while a 2.0x liquidation preference means they get twice their original investment before any other distributions are made.

In 2024, 97% of non-participating shares had a 1x multiple2, which is generally considered founder friendly.

Participating preference shares often have multiples as well, and in 2024, 84% of participating preference shares3 carried a 1.0x multiple.

Because they define the hierarchy of payments for shareholders, liquidation preferences create a "priority stack,"

There are two main types of priority structures:

In 2024, 72% of non-participating shares4 followed the standard priority stack. This emphasises that both founders and investors need to carefully review how much money could be left once others have claimed their liquidation preference.

For founders, especially in early funding rounds, it’s essential to negotiate liquidation preferences to avoid unfavourable terms that can limit your return on exit.

Here’s what you should keep in mind:

In conclusion, liquidation preferences are critical to understand and negotiate properly, they will determine how much return you, your employees, and your investors receive upon an exit. By focusing on keeping liquidation multiples reasonable, avoiding participating preferences when possible, and ensuring clear communication with your investors, you can create a fair structure that benefits all parties involved while maximising your company's long-term success.

Any opinions expressed are merely opinions and not facts. All information in this document is for general informational purposes and not to be construed as professional advice or to create a professional relationship and the information is not intended as a substitute for professional advice. Nothing in this document takes into account your company’s individual circumstances. HSBC Innovation Banking does not make any representations or warranties with respect to the accuracy, applicability, fitness or completeness of this document and the material may not reflect the most current legal or regulatory developments. HSBC Innovation Banking disclaims all liability in respect to actions taken or not taken based on any or all of the contents in this document to the fullest extent permitted by law. Nothing relating to this material should be construed as a solicitation or offer, or recommendation, to acquire or dispose of any investment or to engage in any other transaction.