Founder vesting: What early-stage founders need to know

- Growth

- Article

- 5 minutes read

Founder vesting is a mechanism that gradually “unlocks” the shares allocated to a founder (or key management) over a period of time.

Understandably, founders and investors can have different views on the reasons for vesting.

From a founder’s perspective, vesting can feel like a step backwards. Waiting for shares, particularly if they’ve been working in the business at a below-market salary for a significant time, can be frustrating.

But it’s important to consider vesting from the investors’ view, too. At the earlier stages in particular, investors are investing directly into the founding or management team, and see vesting as a way to make sure that team stays committed to the long-term success of the business. It’s a means to ensure the core team stays on board for a significant time or even exit, when most or all of their shares will be vested. If a co-founder leaves in the early stages of building the company, their unvested shares can be reallocated to a new co-founder. This staggered vesting not only safeguards the company’s stability but also protects investors by ensuring shares aren’t fully vested from day one.

Our recent Term Sheet Guide shows that 58% of term sheets in 2024 included founder vesting, compared to 61% in 20231. However, 42% of term sheets were silent on this emotive clause. It’s recommended to negotiate founder vesting in the term sheet rather than waiting until the long form documents.

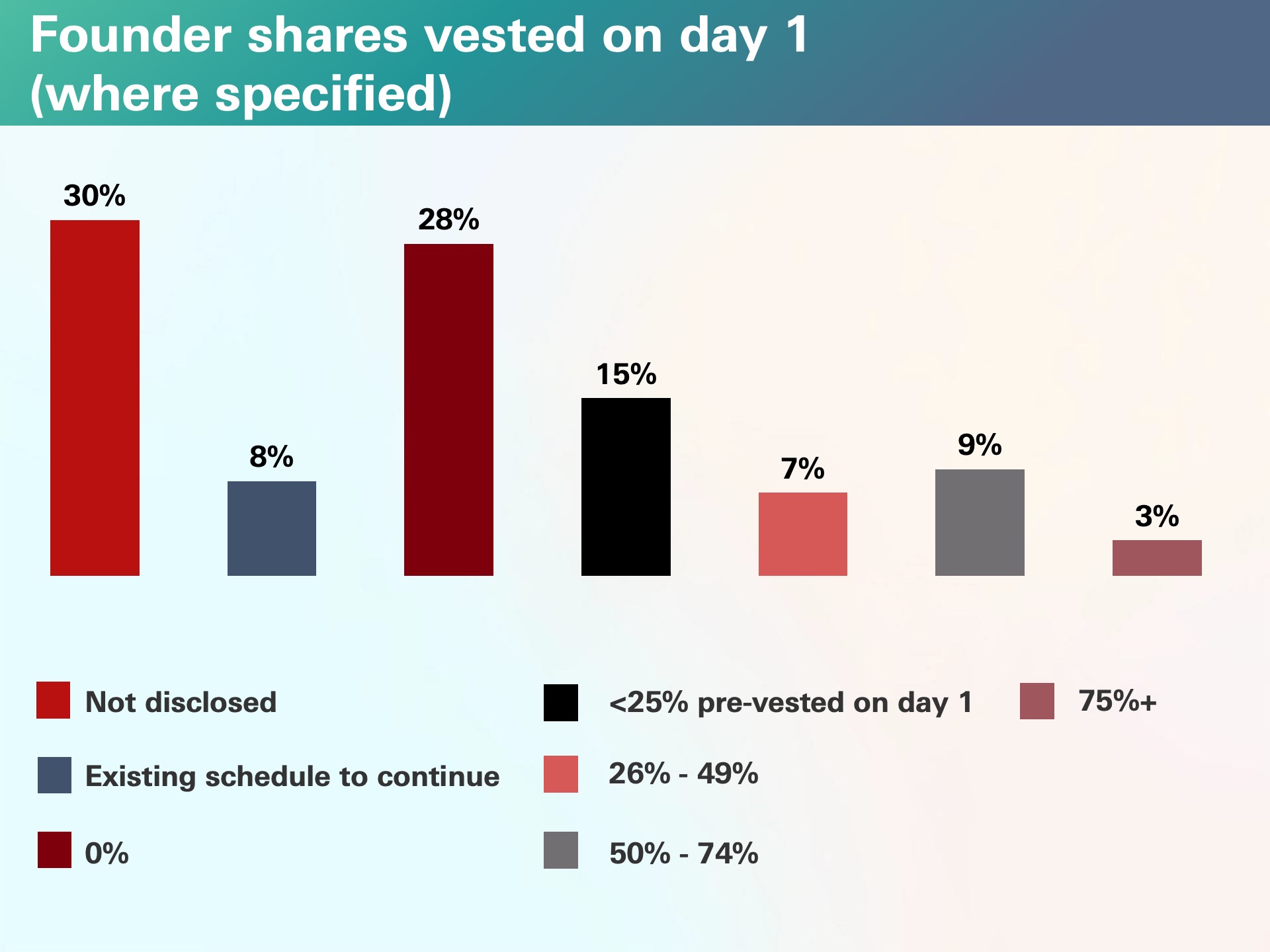

When negotiating founder vesting, founders should carefully consider the proportion of shares to be vested immediately.

Investors may be more flexible if the founder has already built significant value before the funding round. In those cases, founders can negotiate a higher percentage of shares to vest on day 1, particularly if they can demonstrate that they have already achieved key milestones and built considerable value in the company.

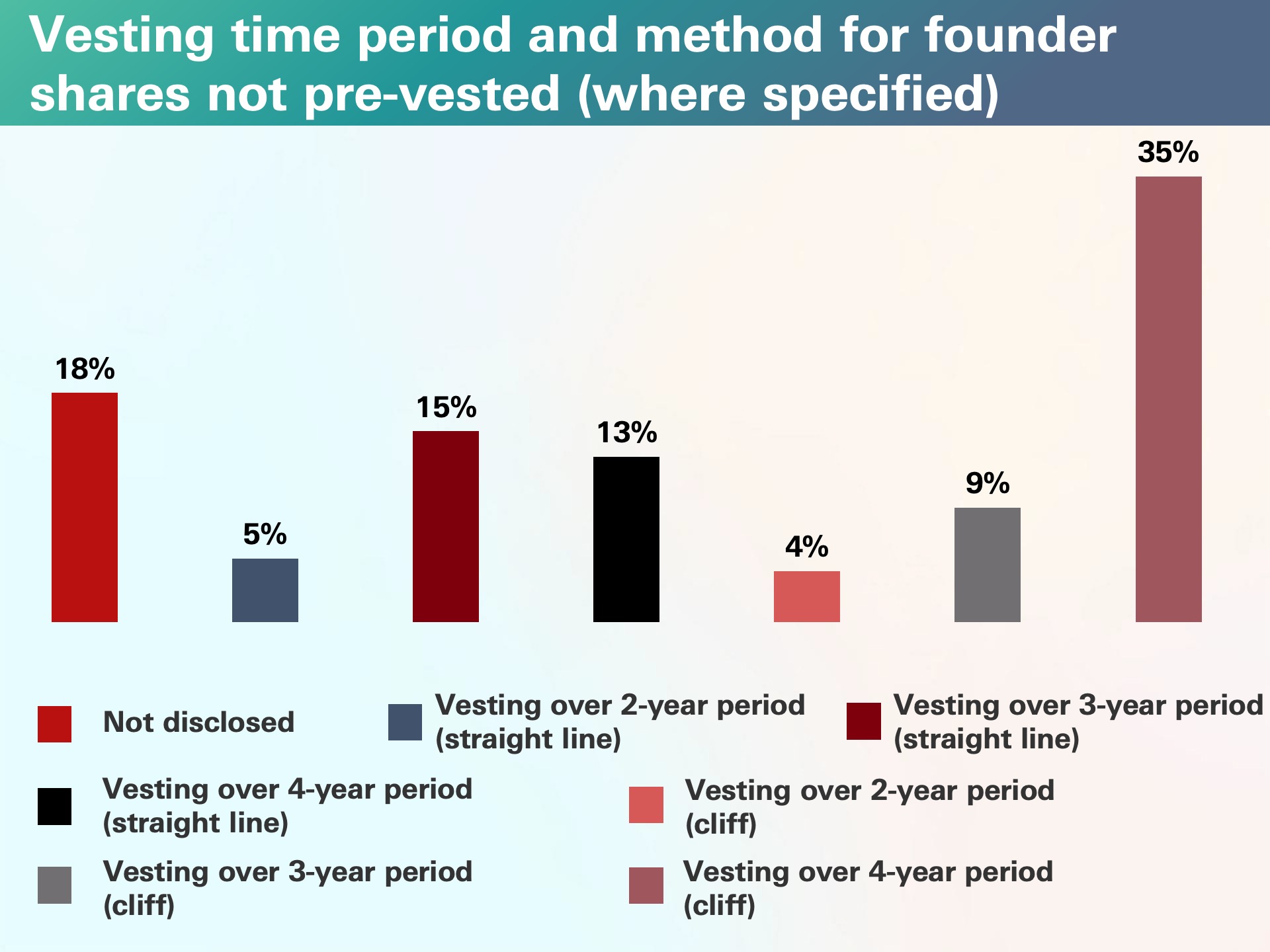

Once the initial portion of shares is vested, the remaining shares are typically vested over a period of time. This is known as the vesting schedule. Most vesting schedules span over two to four years.

The vesting process is typically calculated as a straight line, monthly (or quarterly or annually), or include a “cliff” where shares are partially (or fully) vested on a specified date, and then usually with month straight-line vesting thereafter.

According to our 2025 Term Sheet Guide, a 4-year vesting period with a cliff was the most popular vesting period in 2024. A one-year cliff means that the founder needs to wait 12 months before any of their allocated options start to vest.

Leaver provisions are often absent from term sheets, appearing instead in long-form documents. In 46% of cases, leaver provisions are only handled post term sheet, typically in the shareholder agreement.

However, because these clauses can be sensitive, it’s advisable to address them early in negotiations.

In company agreements, “good leaver” and “bad leaver” clauses define the terms under which an employee or founder exits and the impact on their shares.

A “good leaver” typically leaves due to circumstances beyond their control, such as illness, permanent disability or wrongful termination, and is often eligible to retain or sell their shares at fair market value.

Conversely, a “bad leaver” exits due to misconduct, criminal offences, or other terminations with cause, resulting in a loss of shares or a forced sale at nominal value.

These classifications ensure that departing individuals don’t unfairly benefit from future growth, while enabling the reallocation of shares to incentivise replacements.

When entering funding rounds, founders should expect VCs to include vesting clauses, especially if multiple co-founders are involved.

However, there are ways to negotiate these terms:

Vesting clauses are a common feature in early-stage term sheets and, while they may feel like a constraint, they are a practical tool to ensure both founders and investors are aligned on the company’s future. The goal of vesting is not to penalise founders, but to protect investors and encourage founders to stay committed over the long term.

Any opinions expressed are merely opinions and not facts. All information in this document is for general informational purposes and not to be construed as professional advice or to create a professional relationship and the information is not intended as a substitute for professional advice. Nothing in this document takes into account your company’s individual circumstances. HSBC Innovation Banking does not make any representations or warranties with respect to the accuracy, applicability, fitness or completeness of this document and the material may not reflect the most current legal or regulatory developments. HSBC Innovation Banking disclaims all liability in respect to actions taken or not taken based on any or all of the contents in this document to the fullest extent permitted by law. Nothing relating to this material should be construed as a solicitation or offer, or recommendation, to acquire or dispose of any investment or to engage in any other transaction.