Chasing waterfalls: How to use your term sheet to calculate exit distributions

- Growth

- Article

- 8 minutes read

Earlier this year we released our third Venture Capital Term Sheet Guide 2025 – an analysis of 588 term sheets issued to startup and scaleup founders in 2024.

The term sheets reviewed represent 33% of UK deal volume and 40% of UK deal value (per Pitchbook), making it a comprehensive guide to the economics of funding rounds from seed through to Series C and beyond.

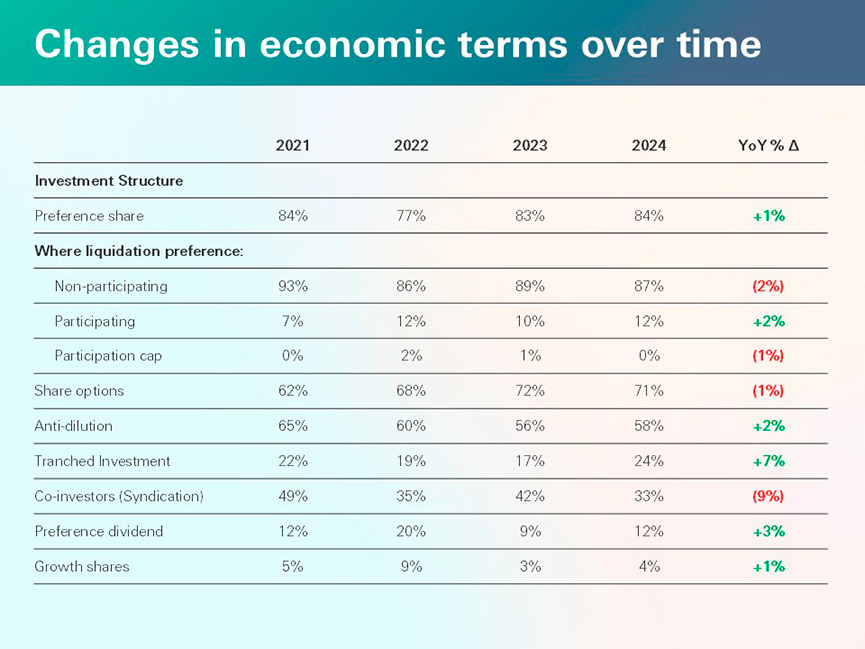

Our report data has shown that term sheets are becoming somewhat more investor-friendly. That means it’s even more important for founders to understand the dynamics of potential deals – which can be full of counterintuitive lessons that are invaluable in the high-stakes equity fundraising process.

For example, a higher valuation doesn’t automatically mean more money as and when you exit.

This article uses this data and other data sources to explain how founders can use their VC term sheets to build robust exit waterfall scenarios.

We also explore some of the common trade-offs faced by founders at this stage of a fundraise: namely, how to balance the ‘headline’ valuation figure against the other economic rights in a term sheet, which can have a huge impact on your waterfall.

First, let’s get to grips with some key terminology.

Term sheets are documents issued by investors to companies outlining the structure of a proposed investment.

Receiving a term sheet is an important milestone during a fundraising process, but it’s important to remember that,” as Carta puts it, the term sheet itself is a “preliminary, non-binding document”.

Term sheets matter because they cover the key parameters of a potential investment, including the pre-money valuation the investor places on the company, how much capital the investor proposes to commit, and economic rights like liquidation preferences, participation rights and anti-dilution clauses (if applicable).

On receiving a term sheet, it’s crucial that founders take the time to model what the terms will mean for the exit waterfall.

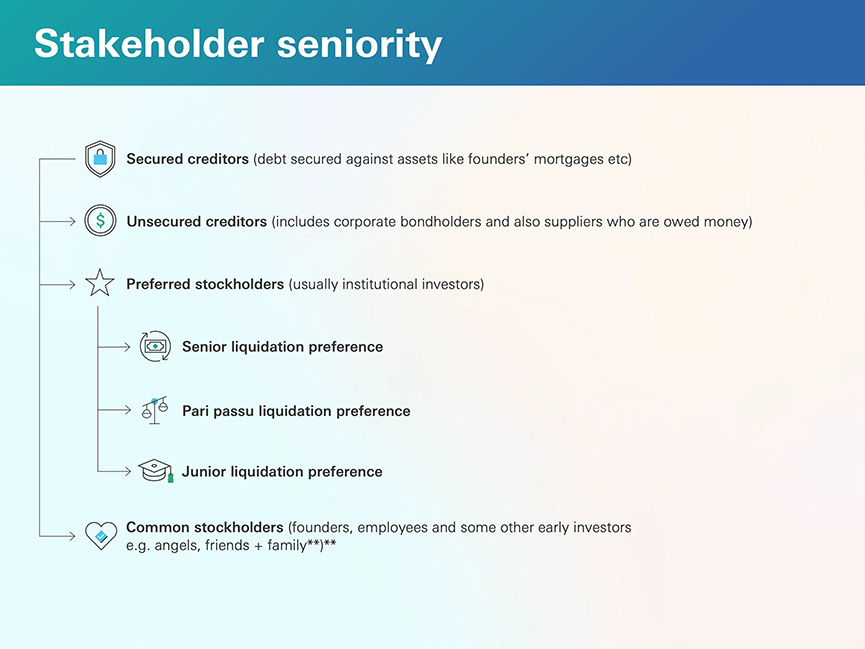

Also known as liquidation waterfalls, exit waterfalls are mechanisms that dictate the distribution of proceeds among shareholders during a liquidity event, such as an acquisition or initial public offering (IPO).

Waterfall models are so-called because of the way funds cascade down from the most senior stockholders to common stockholders in an exit event.

Understanding these structures is crucial for investors, founders, and other stakeholders to anticipate returns and align expectations in the lead-up to, and aftermath of, an exit.

Generally, senior stockholders include investors holding preferred shares and/or a company’s most recent investors, who will be paid out first using the standard ‘last in, first out’ approach to distribution. More junior shareholder groups include founders, employees and early angel investors. While these stockholders potentially stand to realise a higher return on their investment, due to acquiring their shares earlier in the company’s lifespan, they are more likely to own common stock, and so rank junior to the owners of preferred shares.

For founders fortunate enough to receive multiple term sheets, a simple comparison exercise can be really helpful when assessing exit waterfalls.

A process I’ve worked through before is creating a basic table of the key economic and participation clauses in each term sheet, before comparing them side by side on a sheet of paper / excel table.

While useful to assess exit waterfalls, it’s helpful to understand what a ‘standard’ term sheet looks like so that you can compare the merits of different term sheets as a whole.

Term sheets include many technical terms and clauses that can have a big impact on founders’ exit waterfall models.

Let’s look at a few important concepts, and current market standards.

Liquidation preferences

A liquidation preference refers to the order in which shareholders are paid out in an exit. Holders of ‘preferred’ shares – usually investors – are paid back first, before ‘common’ shareholders.

Investors usually specify a multiple of their initial investment that they’ll receive before common stockholders become entitled to their payout. A 1x liquidation preference is the market standard, meaning that at a minimum, the investor’s initial investment is guaranteed to them when the company exits.

If a term sheet features a liquidation preference of more than 1x, founders should take care to ensure that the overall balance of the deal is still competitive. Why? One reason is that non-standard liquidation preferences in one funding round could deter future investors from committing capital, as they might perceive a 1.5x or 2x liquidation preference for one investor as limiting the potential windfall of other investors and shareholder groups.

Participation rights

Participation rights are terms that allow investors to share in the proceeds of an exit beyond their liquidation preference.

Investors’ participation rights are usually pegged to their equity ownership: in a startup that has raised £10 million and exits for £50 million, an investor with participating preferred stock that invests £5 million for a 50% equity stake will receive their initial investment back, then a 50% share of the remaining proceeds. This outcome is materially different to an exit where the investor owns non-participating preferred stock: in this instance, the investor would choose the greater of their liquidation preference (usually investment amount at 1x) or a 50% share of the proceeds in an exit waterfall.

These clauses are relatively rare: in our latest report, only 12% of the term sheets we analysed included participating rights for preferred shareholders. However, participation rights have become more popular in the last 12 months. In analysing more than 150 later-stage funding rounds (Series B and beyond), we observed an 11 percentage point change in the number of term sheets that included participating rights compared to the previous year.

Founder vesting

Investors want to be sure that the founders they invest in are committed for the long term. Although founders own 100% of their equity by default when they start the company, investors may push to establish vesting schedules for founders so that, like employees, they ‘earn’ more of their equity over time. This prevents a founder leaving and tying up a significant portion of the company’s equity.

Last year, 30% of the Series B term sheets we analysed featured founder vesting clauses. This time, the proportion increased to 52%. Founder vesting also spiked in funding rounds at Series C and later, increasing from 30% in last year’s report to 43% this year.

With companies generally taking longer to go public or exit, more investors may seek to establish founder vesting clauses so that founders ‘earn’ their full equity stake over a longer timeframe.

Fundraising founders should adopt the mentality that they no longer own their shares in the same way as when the company was founded, and that they will need to earn their shares over time like other common stockholders.

This is a normal part of growing a company and taking on outside capital, but it’s worth remembering that sharp increase in founder vesting provisions, as well as the growing focus on participation rights at later-stage rounds, indicates that investors may be getting more aggressive in how they structure term sheets.

Antoine Moyroud, Partner, Lightspeed"Participating structures of more than 1x liquidation multiples should only be considered as a last resort option […] Founders should clearly understand the implications of these non-market terms as they will heavily affect the founder’s outcome in the event of an acquisition or exit."

To create an exit waterfall based on an investor term sheet, you’ll need to ensure you have a comprehensive set of information relating to the proposed investment, the conditions applying to different shareholder groups, and the nature of the economic rights enjoyed by preferred and common stockholders.

Preferred stockholders need to factor in:

Common stockholders need to ask:

Vanessa Vasquez, Head of Legal, Seedcamp"Beyond bolstering your company’s credibility, the impact of expert legal guidance extends to significant time and cost savings in the long run […] adept legal counsel not only strengthens your present but also strategically prepares you for your future."

These are a lot of variables for a founder to negotiate during a fundraising process, and of course, priorities may differ.

To support founders in navigating the process, our full report has a page to help you establish which elements of a term sheet negotiation are most important. (Find it on page 34 of the report.)

We have also teamed up with private capital company Carta to develop an exit waterfall modelling tool for UK startups and scaleups. Build your exit waterfall now with Carta’s tool.

Nicholas Richards, Head of Business Development, Carta"Understanding waterfall structures is crucial for founders and investors alike. They give the first and most important signal of whether a deal is going to work, and they ensure that incentives are balanced and motivating for all parties."

There are a few key areas in term sheets for founders to scrutinise especially carefully, as they can have a significant impact on the exit waterfall.

Term sheets with liquidation preferences higher than 1x could represent excessive returns for the investor over other groups of shareholders. Pay attention to participating rights and whether new investors could realise outsize gains in an exit scenario, to the detriment of common stockholders.

If founder vesting terms are included in the term sheet, founders should consider their roadmap to exit and understand whether a shorter vesting period with straight-line vesting might be appropriate.

Helen Murphy, Co-Founder and CEO, Opply"Your term sheet sets the foundation for future rounds, as often investors down the line don’t create many new terms, just adapt the ones in play."

When negotiating funding terms, founders should be vigilant about specific clauses that may seem benign but can ultimately undermine their control, flexibility, and financial outcomes.

On occasion, investors might be willing to invest at a higher valuation if founders accept terms that include higher-than-average liquidation preferences, participating preferred stock, or other restrictive covenants.

These terms may appeal if founders are motivated by hitting a specific valuation. But founders should think carefully about whether to accept a higher valuation if it reduces your control of board-level decisions or limits the upside for common stockholders in the event of an exit.

In startups and scaleups, cash is king. Most venture-backed companies need the commitment of investors to raise the capital required to build leading technology products and scale up the business. But a term sheet with punitive clauses that favour investors in an exit may deter future investors from committing to your long-term vision, as well as reducing the potential outcomes for founders and employees in an exit event.

Weighing up the benefits and drawbacks of the term sheets you receive from investors is a core skill for founders that can add value for all shareholders as your company grows.

Remember: term sheets are a stage in a negotiation, not the final deal.

Any opinions expressed are merely opinions and not facts. All information in this document is for general informational purposes and not to be construed as professional advice or to create a professional relationship and the information is not intended as a substitute for professional advice. Nothing in this document takes into account your company’s individual circumstances. HSBC Innovation Banking does not make any representations or warranties with respect to the accuracy, applicability, fitness or completeness of this document and the material may not reflect the most current legal or regulatory developments. HSBC Innovation Banking disclaims all liability in respect to actions taken or not taken based on any or all of the contents in this document to the fullest extent permitted by law. Nothing relating to this material should be construed as a solicitation or offer, or recommendation, to acquire or dispose of any investment or to engage in any other transaction.

HSBC Innovation Banking, Venture Capital Term Sheet Guide 2025