Money to burn: Understanding and managing burn rate

- Running a business

- Article

- 6 minutes read

Asking a founder how long they’ve got until their business runs out of money may not be the best way to make a new friend. But even companies going through hypergrowth need to be realistic about their runway. After all, cash flow is the number one contributor to business failure.

That makes your burn rate – the speed at which your startup is spending money – a critical metric for founders to monitor.

Companies can (and should) track both gross and net burn rate.

Gross burn rate is the amount you’re spending on operating expenses (OpEx). OpEx usually includes your team’s salaries, equipment, rent, inventory and equipment. They are the fixed costs required to keep your business running.

While it’s important to keep tabs on your OpEx, this data point alone is not enough to give you an accurate estimate of when you’ll run out of money. Net burn rate considers your company’s revenue, making it a more accurate measure of your runway (the time you’ve got until your cash runs out).

Most startups track net burn rate on a monthly basis, but in early-stage companies spending can fluctuate considerably month by month. To arrive at a more reliable figure, many companies choose to take a quarterly, bi-annual or annual average of their net burn.

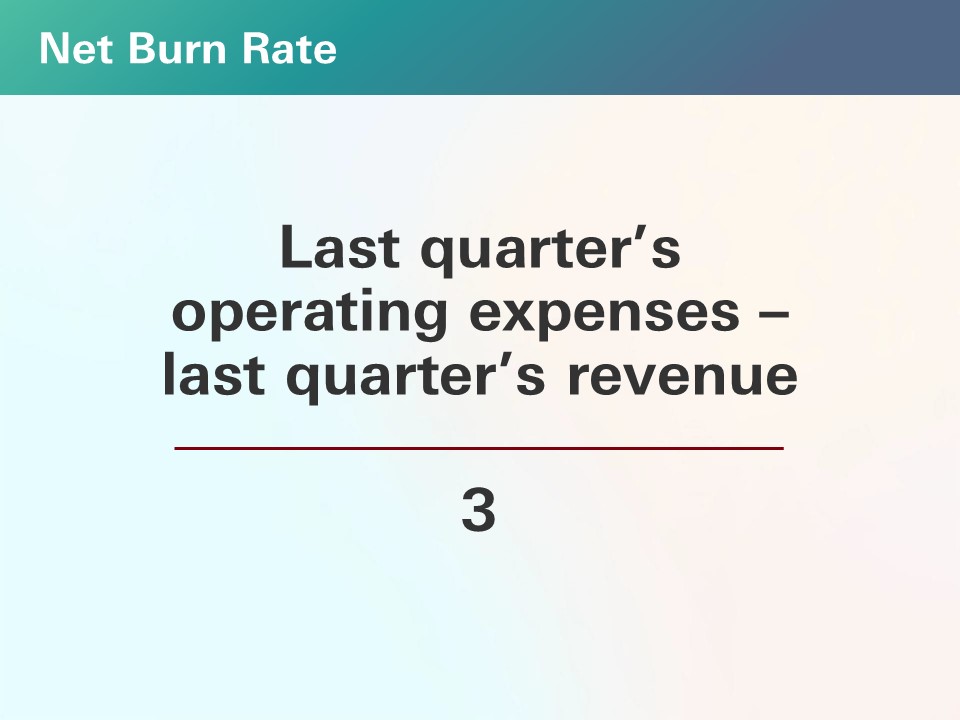

Here’s an example formula for using a quarter’s data to calculate a monthly average of your net burn rate:

Using this example, a company spending £100,000 in January, £115,000 in February and £125,000 in March would have quarterly operating expenses of £340,000. If that company had revenues of £75,000 in January, £80,000 in February and £95,000 in March, its three-month revenues of £250,000 offset its operating expenses to give a loss of £90,000 for the quarter. Dividing that sum by three gives an average monthly net burn rate of £30,000.

Whose money is it that you’re burning? For startups that are backed by venture capital (VC) firms and angel investors – or that want to raise money for the first time – it’s important to understand how to think and communicate about burn rate.

Most, if not all, early-stage investors will expect their portfolio investments to be burning money initially, as expenditure on product development and talent commonly outweighs revenues.

But even in early-stage companies, investors pay close attention to their portfolio companies’ capital efficiency.

Today, more companies than ever are paying close attention to their burn multiple – the amount of money they spend to earn each pound. To calculate your burn multiple, divide your net burn in a given period by your net new annual recurring revenue (ARR) for the same period.

The lower the burn multiple, the more efficient a company’s spend: 1x or below is the gold standard for investors in venture-backed companies. A burn multiple between 1x and 2x is good, but once the burn multiple creeps over 2x, there is room to make improvements, either on the revenue side or in operating expenses.

For example, if a company spends £5 million in a quarter and earns £5 million in net new ARR, its burn multiple is 1x – generally an indicator of outstanding efficiency. If the company spends £5 million and earns £1 million, the burn multiple is 5x – far less efficient.

Metrics like these matter, but so does candour. Founders that can talk openly about their burn rate and burn multiple - putting these in context and using them to highlight how the business is doing - demonstrate that they are reliable stewards of their investors’ capital.

So how do startups go about conducting conversations with investors about their burn rate? Sean Conley, co-founder and CEO of AI-enabled customer research tool Motives, reflects on their experience.

Sean Conley, Co-founder and CEO, Motives"We raised our pre-Seed round a couple of years ago from a mix of angel investors and early-stage VC firms. A couple of those investors ask us for regular updates on our burn rate, so I would recommend that even very early-stage founders at least have a sense of what they’re spending month-on-month. But it’s not the primary topic of our investor communications – in general we focus on new customer wins, product development and so on."

In fundraising conversations, investors will want to understand what you’ll do with the money you’re raising, and how much runway you expect the investment to give you. (The most common way to calculate runway is to divide the cash you have on hand by your average monthly net burn. A startup with £1 million of cash that’s burning £100,000 per month would have 10 months’ runway.)

Sean says, “When we raised our pre-Seed round, we wanted to raise enough to give us two years of runway. We’ve actually been able to make that money last longer than we’d initially expected: that’s down to revenue generation but also being thoughtful about how we’re using our internal resources. We chose to do our website rebuild ourselves, for example, rather than hiring an agency.”

Sean Conley, Co-founder and CEO, Motives"Your revenue and your net burn rate are directly connected. Maintaining a financial model of your runway, with revenue as an input variable, gives you a tool to monitor your commercial performance – whether your revenue is meeting, ahead of, or behind expectations – and how it affects your runway."

Thinking about burn rate in this way can direct your day-to-day decision-making on managing spend, but that’s not all: most founders recommend starting a new fundraising process when you have between nine and 12 months’ runway, so these calculations can have a material impact on your next investment milestones.

Startups have had to cope with shifting messages in the last few years. In the boom period of 2021-22, ‘growth at all costs’ was the mantra and capital was relatively easy to access. Since 2023, VCs have been more selective and there has been a broad recalibration in some startup fundamentals, from valuations to revenue multiples.

Given those changes, it’s unsurprising that the focus for many startup founders has shifted to cash conservation and careful stewardship of investors’ funds.

Outside the VC ecosystem, bootstrapping – choosing not to raise external financing, instead spending only what you earn from your customers – has become a more mainstream option for founders who may have considered the VC route to be the default in the past.

But technology companies need to build quickly to win customers, and the vast majority of founders still need to hire team members to help them win (and service) customers. So what level of burn is healthy, and is there such a thing as burning too little cash?

For Sean, constraining burn rate at Motives was a sensible decision. “We did a lot of testing and iterating as we were evolving our proposition, and we did explore options that turned out to be dead ends,” he says. “Had we spent money more quickly – for instance, making an extra engineering or sales hire – we might have ended up spending more cash just to reach the same conclusions. Thinking back to our earliest stage of development, one or two more hires might not have moved the needle enough to justify that investment.” At the same time, though, bringing new talent on board could help companies unlock the insights that stimulate demand and move the business closer to product-market fit.

Before investing in headcount, startups can explore their options with contractors and agencies to access industry expertise without the overheads created when new employees come on board.

The downside? It’s harder to take the lessons learned from your work with freelancers or agencies and apply them to fuel your company’s longer-term growth. Investing in new hires gives you the best chance of implementing the insights derived from your tests and experiments, recycling them into new best practices for your startup. While every company is different, you should carefully consider what you stand to gain and lose by adopting an ‘efficiency at all costs’ mindset.

It can be tough for startup founders pushing to hit monthly and quarterly goals to think about the longer-term future. But neglecting to monitor data points like burn rate and runway – two of the few truly existential metrics for businesses – comes at a cost. Even when a startup is actively fundraising, investors want to understand how much you plan to burn, and how forward projections may change depending on inputs like your revenue. That’s why understanding your net burn rate and burn multiple, and being ready to communicate straightforwardly about your monthly or quarterly burn, is fundamental for founders.