Budgeting to scale: The true cost of US expansion

- Growth

- Article

- 5 minutes read

The US represents the target business destination for almost every UK-based tech founder, but successfully scaling is an expensive exercise.

From costly talent to expensive commercial real estate, the opportunities on offer come at a cost.

Understanding where you will be spending your money, and how much you may need, is essential to picking your moment and making your expansion plans successful.

We’ve partnered with US Expansion Partners, a team of experienced founders who specialise in helping founders take their business to the US market, to provide an overview of the once-off, and recurring costs founders and Treasurers need to factor into their plans when crunching the numbers to fund that bold move across the Atlantic.

Please note that these are illustrative figures typical of establishing a presence in a smaller tech hub. Actual costs vary significantly by region.

Many of the once-off costs to be covered are associated with registering your business as a Legal entity.

These may include the actual incorporation fees, as well as the State-specific price for filing various documents.

An indicative cost list could include the following:

One key item here is the Transfer Pricing Study – an important accounting process that determines the most tax efficient ways for goods or services to be exchanged by different parts of the same core business.

Although your monthly costs depend on your chosen location and service providers, it’s good to get a sense of what costs you may need to consider beyond employee salaries and benefits, which will represent the bulk of your monthly expenditure.

Costs like renting office space, a phone line, and accounting software alongside basics like banking fees and Wi-Fi can cost anything from $300 to $5000 – and that can add up quickly.

Selecting your site carefully and shopping around are crucial for founders and CFOs as they try to maximise value and spend wisely.

As we mentioned in a previous article, it is vital to structure employee benefits in a way that helps you attract top talent.

In general, these costs fall into two categories: salaries, and compulsory costs.

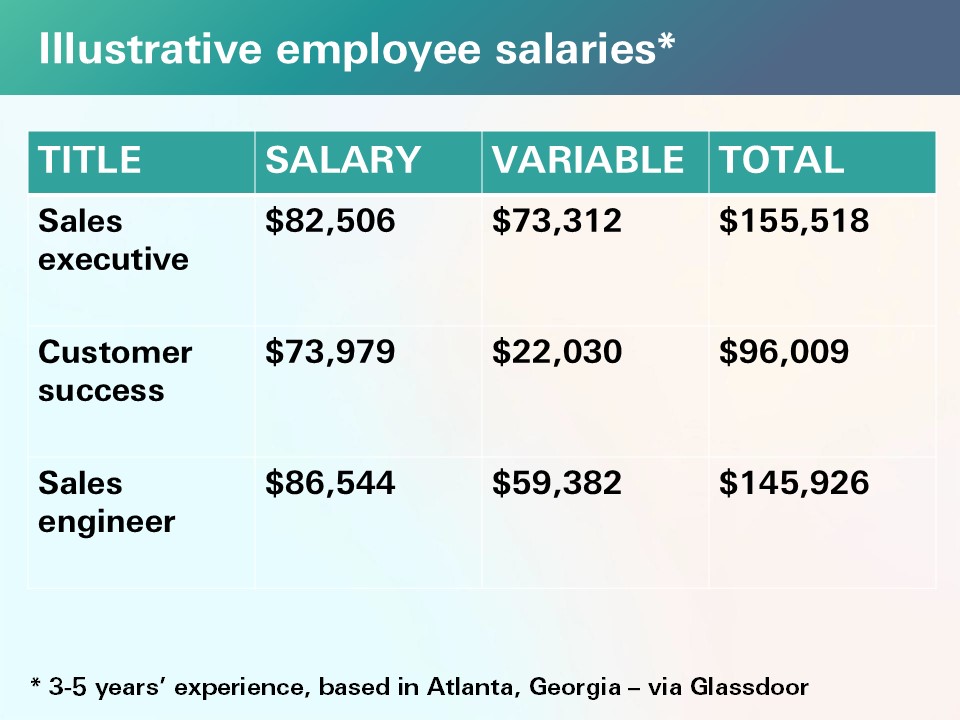

The below table gives you an idea of these costs for your go-to-market sales team:

In addition, you need to think about the various taxes associated with being an active employer.

These include:

FUTA - Federal Unemployment Tax

6% tax on the first $7000 in wages

FICA - Federal Insurance Contribution Act Tax

7.64% tax on the first $147,000 in wages)

SUI – State Unemployment Tax

Varied by state and job code.

Another area that can be used to attract talent, at a price, is health insurance. In addition to health insurance, US companies may offer employees dental, vision, life and disability insurance, all calculated using different contribution strategies which will see the company covering a specific percentage of the total monthly cost – often 50% or 100%.

Due to the structure of the healthcare system, benefits can be the swing factor in attracting top talent, so it’s important to balance the books and your ability to bring in the best and brightest.

Similarly, you will have to cover each employees’ 401K: the employer-sponsored, defined-contribution, personal pension (savings) account for your employees. While there is no annual fee, you will need to pay a once-off implementation fee of $500, and select the appropriate contribution option, which can be 0%, “basic” where the employer matches 50% on first 6% of employee contributions, and direct, 1:1 matching.

Additional taxes and insurance should also be included when calculating your overall expansion costs.

These may include:

David Rose, CEO and Founder, US Expansion Partners"Meticulous budget planning is the cornerstone of a successful international expansion strategy."

As with any business decision, understanding the costs associated with expanding to the US is crucial.

While each state has different rates, these broad figures will hopefully give you a clear picture of the costs associated with expanding; costs that your current business may need to absorb.

As ever, we encourage you to seek expert guidance when doing that maths, or math, for your own potential move.

Any opinions expressed are merely opinions and not facts. All information in this document is for general informational purposes and not to be construed as professional advice or to create a professional relationship and the information is not intended as a substitute for professional advice. Nothing in this document takes into account your company’s individual circumstances. HSBC Innovation Banking does not make any representations or warranties with respect to the accuracy, applicability, fitness or completeness of this document and the material may not reflect the most current legal or regulatory developments. HSBC Innovation Banking disclaims all liability in respect to actions taken or not taken based on any or all of the contents in this document to the fullest extent permitted by law. Nothing relating to this material should be construed as a solicitation or offer, or recommendation, to acquire or dispose of any investment or to engage in any other transaction.

* The BE-13 form is mandatory for all non-US residents or entities that are forming or acquiring a business in the United States, and must be completed in the following scenarios:

¹ Clemta, Understanding the Form BE-13: What It Is and What Foreign Investors Need to Know, accessed March 2025