Virtual Card

Virtual Card in detail

If you're looking for a flexible payment method to effortlessly settle supplier invoices, whether over the phone or online, we have you covered. Our Virtual Card solution provides secure payment for goods and services, giving you the ability to use Virtual Card Numbers (VCNs) to settle supplier invoices without the need to deploy physical cards across your organisation.

Our service allows you to streamline your supplier spending by consolidating all card-based transactions into one simple monthly payment, enhancing your financial management.

You can also improve the efficiency and security of your processes while gaining greater visibility over your expenditures. Whether you need to book travel for your staff without the hassle of corporate cards, or if you're currently managing a manual hotel billback process, our solution is designed to simplify these tasks for you.

Overview

- Secure Online Transactions: The Virtual Card provides a unique card number for online purchases, enhancing security by minimising the risk of fraud and protecting your business's financial information.

- Instant Issuance: Easily generate a Virtual Card instantly through your banking platform, allowing for immediate use without the need to wait for a physical card to arrive.

- Controlled Spending: Set specific spending limits and expiration dates for each Virtual Card, giving you greater control over your budget and helping to manage expenses effectively.

- Convenient Integration: The Virtual Card can be seamlessly integrated with various online payment platforms and services, streamlining your purchasing process and enhancing operational efficiency.

Key features

- Can be used instead of issuing physical cards to departments or individuals

- Secure management of all card data to PCI DSS standards

- Pre-transaction approval steps with user profiles to manage limits, functions, and approvals add an additional layer of security

- Add transaction or invoice data up-front to simplify reconciliation of transactions

- Achieve enhanced purchasing policy control through greater visibility of spend data

- Data integration allows matching of booker details, invoice, cost centre, and card transaction data

- Automated matching of transactions that can be monitored and reviewed online

- Simple solutions that can be tailored to your requirements

- Automate invoice reconciliation by using virtual card data provided daily, weekly, or monthly as required

- Three flexible options are available: an online portal that allows for the setup of an approval flow, user access restrictions to specific supplier profiles, and unlimited custom data fields; a central travel booking system that integrates with your travel management company to capture hotel spend through travel agents or procurement systems; and a batch payment process that facilitates automatic invoice settlement via your card programme.

T&Cs, fees and other eligibility criteria may apply

Key benefits

- Eliminates the need for a physical card, allowing you to create and manage unique Virtual Card Numbers (VCNs) for supplier payments, with options for single or specified multi-use and robust user-defined controls.

- Available in GBP, EUR, and USD, with access to the Mastercard network for maximum global acceptance.

- Pay suppliers over the phone, online or on receipt of an invoice.

- Integrate your Virtual Card with your accounts payable system.

- Get enhanced security with authorisation controls, including spend limits and validity ranges, along with the option to add approval flows for further protection.

- Consolidate spending with a monthly statement, automated reconciliation using unique VCNs matched to non-financial data, and access to an online reporting platform.

Deployment options

An HSBC Innovation Banking Virtual Card is a highly configurable solution with options for generating VCNs via a web-based portal, batch file upload or API integration into e-procurement systems or booking tools.

Web-based portal

The process begins when the buyer orders goods or services directly from a supplier's website. When payment is required, the authorised buyer accesses the HSBC Virtual Card portal, where they can pre-enter invoice or reference information into customised fields. A VCN is then generated and used to complete the payment. As part of this process, reference and transaction information is automatically matched, providing accurate reconciliation data, such as aligning the order or booking reference with the cost centre.

Additionally, there is an option to set up a workflow for routing VCN requests to a supervisor, who will approve the request before the payment is finalised. This streamlined approach ensures efficiency and accuracy in managing transactions.

Batch file upload

To request multiple VCNs, you can upload a batch payment file. This file follows a simple format that details the suppliers you wish to settle with. You have the flexibility to submit a batch file daily, weekly, or monthly depending on your needs. Each supplier is assigned a unique single-use VCN with an authorised amount specified in the file. Additionally, any reference or transaction data included in the batch file is automatically matched, providing accurate reconciliation data, such as aligning the instruction reference with the payment reference. It's important to note that there is no cost associated with including the batch file option in our virtual card web-based solution, making it a convenient and cost-effective choice for managing your payments.

API integration¹

VCNs can be generated via a direct connection to your enterprise resource planning system (ERP), e-procurement, accounts payable, or financial system. That means you can continue to use your existing procurement processes to order goods and services from suppliers as usual, utilising your e-procurement tool.

Once a payment is authorised, a VCN with the specified authorised amount is created and can be sent directly to the supplier for processing. It is important to note that full IT integration is required to facilitate this integration and ensure the smooth operation of the system.¹ Unmatched transactions are manually reconciled by either the client or your Travel Management Company (TMC)

How it works

Virtual card portal

Simply order the goods or book the services through the supplier as normal. When a payment card is needed, access HSBC’s Virtual Card portal to input reference details and transaction information before a card number is generated and displayed to complete the transaction. The transaction details and the reference information will then be matched together to provide accurate payment reconciliation data, for example matching of order/booking reference to an employee/cost centre.

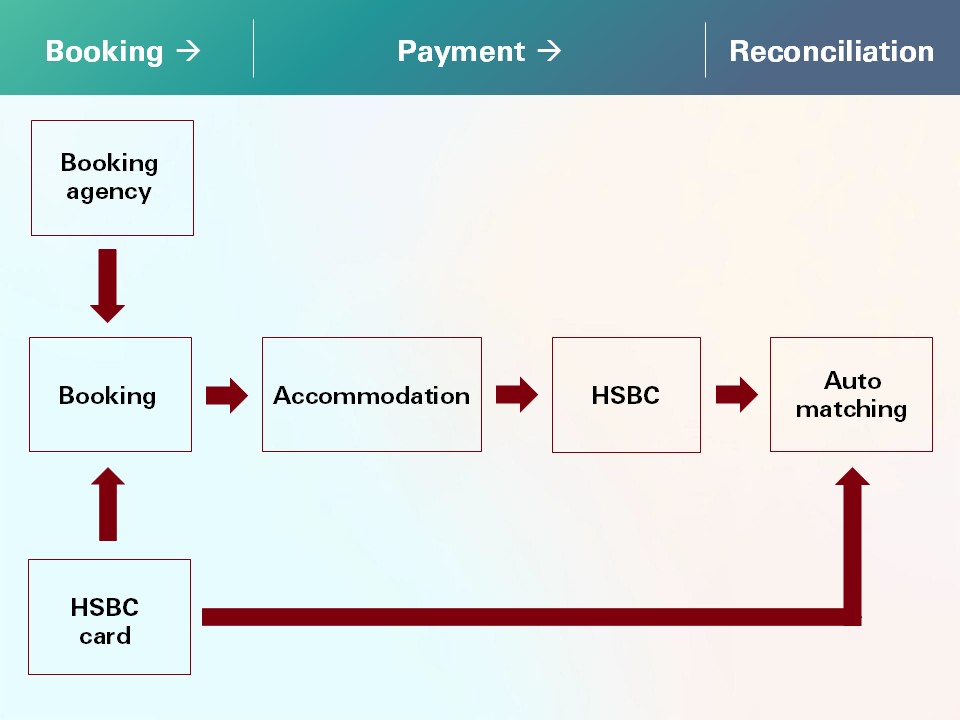

Central cards booking

Our central travel booking solution can be integrated into your existing process with the added benefit of aligning the booking and transaction data to match the traveller with the transaction activity, highlighting policy spend and enhancing travel policy compliance.

Batch payments

Our secure batch payment process allows you to request cards in bulk directly from your ERP system for multiple supplier payments while still providing automated matching.