Business Notice Account

A Business Notice Account (BNA) is aimed at clients who can confidently plan their cash expenditure in advance, and who meet our minimum deposit requirements. Benefit from competitive rates, monthly statements and access to cash after your chosen notice period.

Our Business Notice Account in detail

Our clients often look for the best rates to maximise their investment after a cash injection. However, many have irregular expenditures and need a solution without the restriction of a long-term deposit.

HSBC Innovation Banking’s Business Notice Account is an investment solution that addresses this challenge.

The account gives you the benefit of comparatively higher interest rates *, regular deposits and access to your cash funds after your chosen notice period. You can set up Business Notice Accounts for GBP, EUR and USD and use them on an ongoing basis, rather than going through the hassle of continuously opening multiple term deposits.

Your funds will remain restricted until you provide a notice of withdrawal and the notice period has been fulfilled. After the completion of the agreed notice period, you will be able to access your cash. These accounts can be utilised in conjunction with your current accounts to optimise interest on surplus working capital that is not needed on a regular basis.

*Compared to HSBC Innovation Banking’s standard corporate deposit account.

Overview

- Higher Interest Rates: Benefit from competitive interest rates compared to our standard corporate deposit account, maximising returns on your excess working capital.

- Flexible Access: Access your funds after a predefined notice period, allowing for effective cash management without the restrictions of longer-term deposits.

- Multi-Currency Options: Set up accounts in GBP, EUR, and USD.

- Streamlined Management: Use the Business Notice Account alongside your current accounts to optimise interest on surplus funds without the hassle of managing multiple term deposits.

Key features

- Top up your account anytime

- Make partial withdrawals and access your funds after the relevant notice period expires

- Published rates

- Online banking statements in GBP, USD, EUR

- Interest paid monthly into your linked account

- Monthly statements detailing balances and transactions

This account is not for you if you need immediate access to your funds. This is a restricted access account, and your funds are not available until completion of the notice period.

T&Cs and other eligibility criteria apply

Key benefits

- Interest rates are variable and linked to central bank rates (you can view these in the Summary Box or by contacting Client Services)

- Better interest rates when compared to our standard corporate deposit account

- Partial withdrawals** can be accessed after notice is given and the notice period is completed

- Unlike term deposits, you don’t need to remember to reinvest on maturity

**Minimum deposit requirement applies

Giving Notice

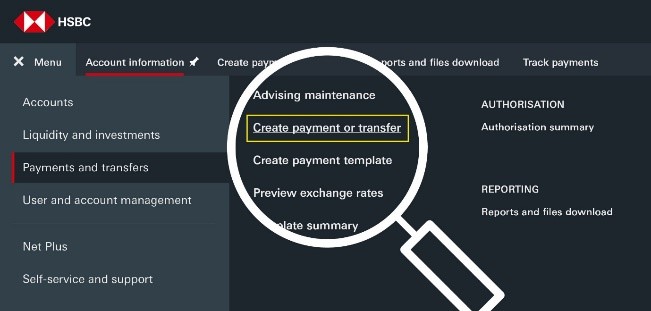

You can give notice to withdraw some or all of your deposit from your Business Notice Account within HSBCnet by clicking on ‘Menu’, selecting ‘Payments and transfers’ and choosing ‘Create payment or transfer’. Once we receive your instruction, we’ll debit the requested amount from your BNA and move the funds into a separate Term Deposit account.

The funds withdrawn from your BNA will be placed in a Term Deposit account for the length of your BNA notice period. While your funds remain in the Term Deposit, we’ll pay you interest (please see the BNA summary box for details).